The New World of Drawback Trading

We have been talking a lot about the passing of the Trade Facilitation and Trade Enforcement Act of 2015 (with Drawback Simplification) known as “TFTEA” for the past year, highlighting the opportunities that it will offer claimants when it goes into effect. Along with drawback simplification comes a unique opportunity called drawback trading that is currently only eligible under petroleum derivatives, but will be available for all commodities under the new law. Drawback trading is another useful tool to provide duty recovery to companies for transactions which would otherwise go unclaimed.

Drawback trading creates an additional duty drawback opportunity for companies that have excess imports or exports that are not currently being claimed. It also can benefit companies that are only importing or exporting, and therefore cannot currently claim drawback under the existing statute. Drawback trading becomes available with the new drawback substitution concept that TFTEA allows for based on the 8 or 10 digit HTS classification (see our article here).

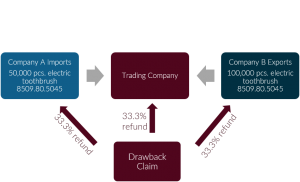

In a nutshell, drawback trading takes excess imports from one company, excess exports from another company, and involves a third party who marries the identical 8 or 10 digit HTS numbers together and files a claim on their behalf. Everyone involved receives one third of the drawback refund.

So how does the drawback trading concept work?

First, make sure you are maximizing your drawback potential, including identifying your future drawback opportunity under the new law, keeping in mind that you get 99% of refunds in these instances. We are happy to help with this and have found that ACE is a great tool for this! Once that analysis is complete, it should identify the imports or exports that are not claimable and are considered excess. The HTS number is key for the next step – identifying if there are companies that have the same HTS number as a corresponding excess import or export. This identification is done by a trading company that we work closely with. When that match is identified and both companies have agreed to the drawback trading, logistical details are worked out to determine when the trading company can take ownership of the merchandise in each of the supply chains. This is necessary in order for that trading company to have legal rights for the drawback claim.

As an example:

- Company A imports 50,000 pcs of an electric toothbrush classified under HTS #8509.80.5045 that they do not export.

- Company B has excess exports of 100,000 pcs of an electric toothbrush classified under HTS #8509.80.5045 that they do not import.

- These two companies are matched by the trading company and a drawback claim is filed using the imports from Company A with the exports of Company B. The refund is split three ways.

The new law will be in effect soon so it’s time to get started analyzing your data, looking for excess imports or exports that are not being used internally. Comstock and Holt are already taking steps for our clients and welcome the opportunity to speak with you about any questions you may have and to assist with your analysis and future drawback needs. Let us help you improve your bottom line by maximizing your drawback program!